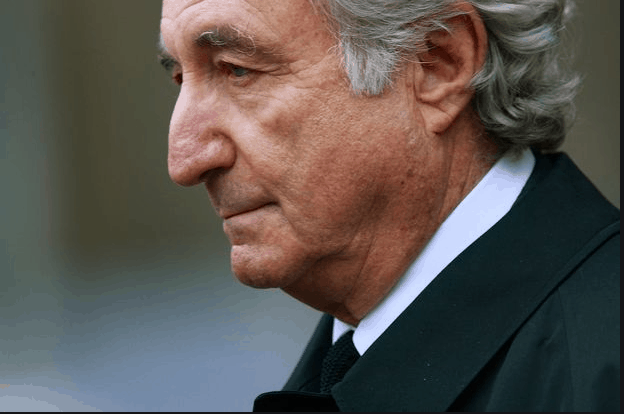

Bernie Madoff, who in 2008 admitted to one of the biggest investor frauds in history, died in federal prison last Wednesday.

As part of his fraudulent operation, Madoff issued phony account statements, reported steady gains of about 10% per year, and made cash distributions promptly when clients asked for them. Of course, the cash he paid was stolen from other clients.

Conservative investors fell hard for Madoff, and no wonder. He was a prominent figure of the establishment and seemed a model of success. He had been chairman of the NASDAQ Stock Market, was a noted philanthropist, and served as the chairman of the board of trustees for Yeshiva University. The steady gains he reported seemed to signal low risk.

But Madoff was also a sociopath. He didn’t care about the feelings or rights of others. He stole from friends, charities and religious groups. A court-appointed trustee for his victims estimated that he stole $17 billion.

So, it was understandable that there was a tone of “good riddance” when reporters announced that Madoff had died. One less cheat in the world.

And then the financial media moved on to other, more exciting stories. What is the outlook for cryptocurrencies? Hear us discuss the latest IPO that’s making so many investors rich. Watch us interview the top investment bloggers and hear which stocks they expect to double or triple this year.

Beware of Misplaced Trust

Which brings us back to Bernie Madoff. When it comes down to it, his investors lost billions because of misplaced trust. They believed what they saw, or thought they saw.

Madoff seemed rich and successful. People around him seemed to be making money year after year. Appearances were everything. Hardly anyone cared when Barron’s and other publications said there was something fishy about his investment record.

Spectacular frauds like Madoff’s happen maybe once in a generation. You’re not likely to be taken in by such a scheme.

But there’s a very real danger that you, too, will fall for appearances. You may feel drawn to follow what the apparently successful “crowd” is doing, even when this means, as at present, making one crazy gamble after another.

Barry Dunaway, CFA®

Managing Director

America First Investment Advisors, LLC

Omaha, Nebraska

This post expresses the views of the author as of the date of publication. America First Investment Advisors has no obligation to update the information in it. Be aware that past performance is no indication of future performance, and that wherever there is the potential for profit there is also the possibility of loss.