Is the board of Omaha-based Berkshire Hathaway doing a bad job for shareholders? At least two firms that advise pension plans and other big investors say yes, governance is poor..

How can this be?

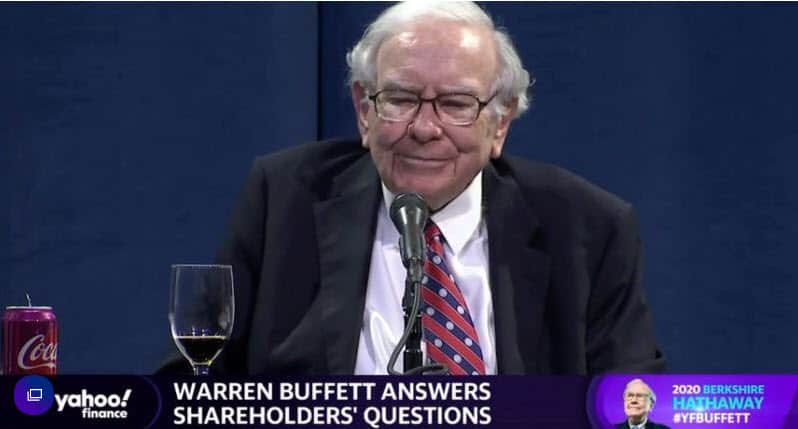

Warren Buffett, the Chairman & CEO, is widely considered the best investor of the past century. Long-time shareholders of Berkshire have been richly rewarded. If any of them have complained, it hasn’t been recorded.

Furthermore, through his Letters to Shareholders, seminars with business students, and countless interviews, Buffett has championed rationality in management.

Faulting Governance at Berkshire Hathaway

Yet Institutional Shareholder Services (ISS) and Sustainalytics say that corporate governance at Berkshire is close to the worst there is among publicly-traded companies. They fault the board for not ticking the right boxes when it comes to what the firms consider good policy.

In a report issued earlier this month, ISS faulted the board for several things:

- Directors are too old.

- Directors have served too long.

- There is not a 50-50 representation of men and women.

- There is insufficient detail that shows how executive pay is determined. ISS does note that Buffett is paid less than 98% of his peers.

Competing Narratives on Governance at Berkshire

A. The Governance Expert Narrative.

The governance firms have created checklists that embody certain assumptions about directors:

- Age = bad

- Long tenure = bad

- Executives of a company on board = bad

- Large percentage ownership by a CEO = bad

There is a narrative where these factors could be bad for shareholders. A self-serving CEO might gain control of a company, stock the board with doddering old men, then have them rubberstamp decisions that will serve his selfish interests.

B. The Evidence-Based Narrative

In the case of Berkshire Hathaway, we have the benefit of examining Buffett’s more than 50-year record at the company. Has he used his control of the company to the detriment of shareholders? Has his ownership perhaps made him more keenly interested in making sound decisions?

And just who are these directors at Berkshire Hathaway? Are they yes-men, or do they have a record of accomplishment in their own right?

Even a glance at the board shows that Berkshire has some of the most talented people in business. Is Vice Chairman Charlie Munger bad for shareholders because he is 96 years old, has served on the board for 42 years, and is an executive of the company? Or does his record and the performance of the company suggest that he has business judgment that few have ever had?

The Absurdity in a Nutshell

Despite an astonishing record of creating value over decades, Berkshire Hathaway has received nearly the worst-possible score for corporate governance.

This suggests that the governance experts might assign a higher rating to a company where a board loots the treasury and drives it into bankruptcy. If the directors are young and haven’t been on the job too long, why not?

And I’ll Raise You One

At an annual meeting, Buffett said he doesn’t want employees to waste time answering requests for information from these advisory firms. He has little patience for activities that add no value or promise to hurt results.

This stand shows a respect for rationality and ethics that should add points to an already exemplary governance record.

You can read more about how we evaluate a company’s management.

To learn about our approach to financial planning, see our post “Find a Good Financial Advisor in Omaha.”

Barry Dunaway, CFA®

Managing Director

America First Investment Advisors, LLC

This post expresses the views of the author as of the date of publication. America First Investment Advisors has no obligation to update the information in it. Be aware that past performance is no indication of future performance, and that wherever there is the potential for profit there is also the possibility of loss.